Exim Bank Probable Double Benefit Scheme । তিন বছরে দ্বিগুন হবে আমানত!

ডাবল বেনিফিট স্কিম ২০২২ – বাংলাদেশের যে কেউ চাইলে এ স্কিমটি চালু করতে পারে– তিন বছরে দ্বিগুন হবে আমানত!

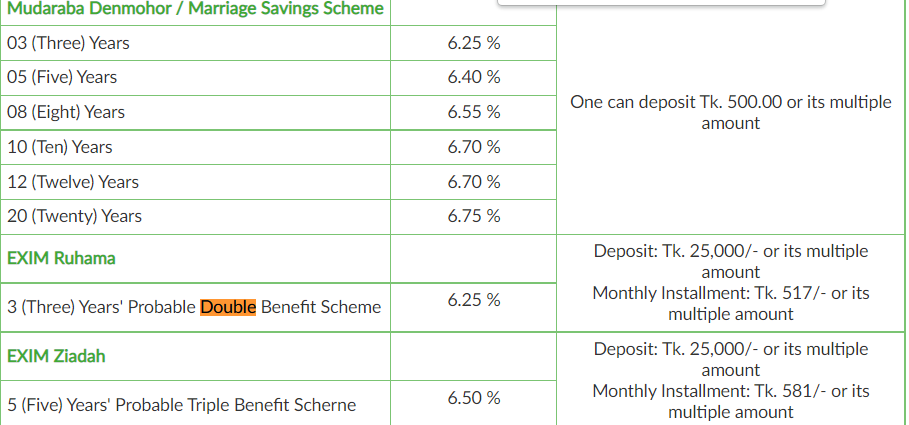

EXIM RUHAMA- Three Years’ Probable Double Benefit Scheme– Any adult person (individually or jointly) having sound mind can open Exim Ruhama Three Years’ Probable Double Benefit Scheme account with any branch of the bank by depositing at least Tk. 25,000/- (twenty five thousand) and its multiple amount with monthly installment defined by the bank and its multiple as the case may be (changeable from time to time).

Tenure of EXIM RUHAMA will be 03 (three) years. Normally, deposited amount of Three Years’ Probable Double Benefit Scheme is not encashable before maturity. If any depositor intends to encash his/her receipt before maturity due to unavoidable circumstances, the following terms & conditions will come into force- i. No profit shall be allowed for premature encashment within 01 (one) year.ii. Profit shall be allowed at the prevailing provisional rate of profit of Mudaraba Savings Deposit after one year but before maturity.

Investment facility under the Scheme- Investment against lien of such receipt may be allowed up to 90% of deposited amount subject to application of normal terms & conditions of investment of the bank. If the depositor expires after availing a investment facility, the balance of the account will be paid to the nominee/heir(s) after making full adjustment of the Investment facility with accrued profit and other charges, if any.

আমানত দ্বিগুন হবে তিন বছরে তাও আবার ৬.৫% ইন্টারেস্ট রেট প্রয়োগ করে? অসম্ভব ব্যাপার! হ্যাঁ আপনার বুঝতে ভুল হয়েছে। আসুন একটু পরিস্কার করে ঝেড়ে কাশি- ধরুন আপনি এককালীন ৫০,০০০টাকা ব্যাংকে রাখলেন যেটা ব্যাংকে জমা থাকবে। আবার প্রতি মাসে ১০৭০ করে টাকা তিন বছর জমা রাখবেন। অর্থাৎ তিন বছরে জমা রাখলেন (৩৬*১০৭০) = ৩৮,৫২০ টাকা। তাহলে টোটাল ব্যাংকে জমার টাকার পরিমান দাঁড়াল (৫০,০০০+৩৮,৫২০) = ৮৮৫২০ টাকা। ব্যাংক আপনাকে দিবে ১,০০,০০০ টাকা। তাহলে মুনাফা দাঁড়াল ১,০০,০০০- ৮৮,৫২০ = ১১,৪৮০ টাকা। মুনাফার উপর ১৫% ভ্যাট কর্তন করে রাখা হবে। DPS Rate in Bangladesh 2022 । কোন ব্যাংকে ডিপিএস খুললে ভালো হবে

২৫ হাজার টাকা প্রাথমিক বিনিয়োগ এবং পরবর্তীতে ৫১৭ টাকা করে ৩৬ মাস কিস্তি / মেয়াদ পূর্তিতে ৫০ হাজার টাকা হাতে পাবেন।

No cheque book will be issued under the scheme. If there occurs any loss in the business, the same to be borne by the Saheb-Al-Maal. The laws, rules & regulations of Bangladesh, custom & procedures applicable to the scheduled bank in Bangladesh shall apply to and govern the conduct of the account opened with bank. Though the Bank maintains strict confidentiality in all affairs of the account, Bank shall always be entitled to disclose any information regarding customers’ account(s) held with the Bank to any of the followings- i. Any regulatory, supervisory, governmental or quasi governmental authority with the jurisdiction over the bank. ii. Any person to whom the bank is required or authorized by law or court order to make disclosure.

মেয়াদ পূর্তিতে মুনাফা হতে ১৫% উৎসে কর কেটে রাখা হবে।

Exim Bank Probable Double Benefit Scheme Terms & Conditions

- Account can be opened in the name of a minor under operation of a guardian.

- The account will be operated as per Mudaraba Principles.

- One or more account can be opened in the same name at the same branch of the bank.

- Weightage for Three Years’ Probable Double Benefit Scheme account will be 1.29, changeable from time to time.

- A specially designed receipt will be issued favoring the depositor(s) at the time of opening the account. The account holder must preserve the receipt carefully. In case of loss of the receipt, bank must be informed without delay and account holder may be allowed a duplicate receipt of the same subject to submission of an indemnity bond. Bank will apply due formalities in this regard.

- Account can be opened in any banking day of the month. But the subsequent installments shall become due for deposit on day the account was opened/the next working day if that day be a holiday.

- Depositor can give standing instruction to the bank to transfer regular installment from his/her account maintained with the branch.

- In case of nonpayment of installment timely, the account will not get the expected benefit.

- If the depositor fails to deposit 03 (three) consecutive installments at any point of time, it will cease the right of depositor to remain within the purview of the account and profit against balance of deposited amount will be allowed as per terms & conditions mentioned in the following clause. However the depositor may be allowed to continue the account till maturity by depositing the arrear installments with due approval from the competent authority.

- In case of death of account holder(s), the nominee(s) may continue the account till maturity.

স্কিমটি খুলতে কি কি ডকুমেন্ট লাগবে?

Requirements- Two copies of recent passport size photographs of account holder attested by the introducer. One copy passport size photograph of nominee attested by the account holder. Copy of Passport/National ID Card/Word Commissioner’s Certificate of the account holder acceptable to the bank.